Get a handle on market caps to better understand blended funds

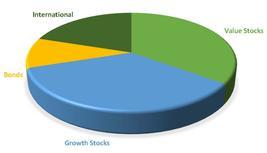

We’ve touched on value and growth stocks, and because we financial types aren’t all that creative, it won’t surprise you to learn that blended funds are a combination of the two. However, if you have done much reading on how to diversify your portfolio, you likely have come across similar terms such as “hybrid” and “balanced” funds.

Although the function of these funds—to build a portfolio with investments of differing levels of risk—is the same, these labels are not interchangeable.

To better understand blended funds, it is helpful to know a little about market capitalization.

I’m sure you have heard of the terms large cap, mid cap, and small cap to describe certain companies and their stocks.

Market capitalization is a method of determining the worth of a stock that doesn’t rely on figures such as total sales or assets, which can vary dramatically from industry to industry. The market cap is derived by multiplying the number of shares currently owned by investors by the price of a single share of that stock.

For large-cap stocks, that figure is $10 billion or more; mid-cap stocks are between $2 billion and $10 billion; and small-cap companies are $300 million to $2 billion.

There are other cap categories such as “mega,” “micro,” and “nano” that more precisely segment companies and their stocks, but it’s not necessary for us to explore those in detail at this time.

Market capitalization provides an “apples to apples” approach to assessing the vast numbers and types of companies currently available for consideration by potential stockholders.

Blended funds are created by purchasing value and growth stocks from different companies within the same market capitalization category. We will look at hybrids and balanced funds in the next post.

If you are concerned that your portfolio lacks diversity, give us a call. The first consultation is free, and if you follow-up, use this Groupon for a 50 percent discount.